estate tax exclusion amount sunset

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. With certain limitations California.

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

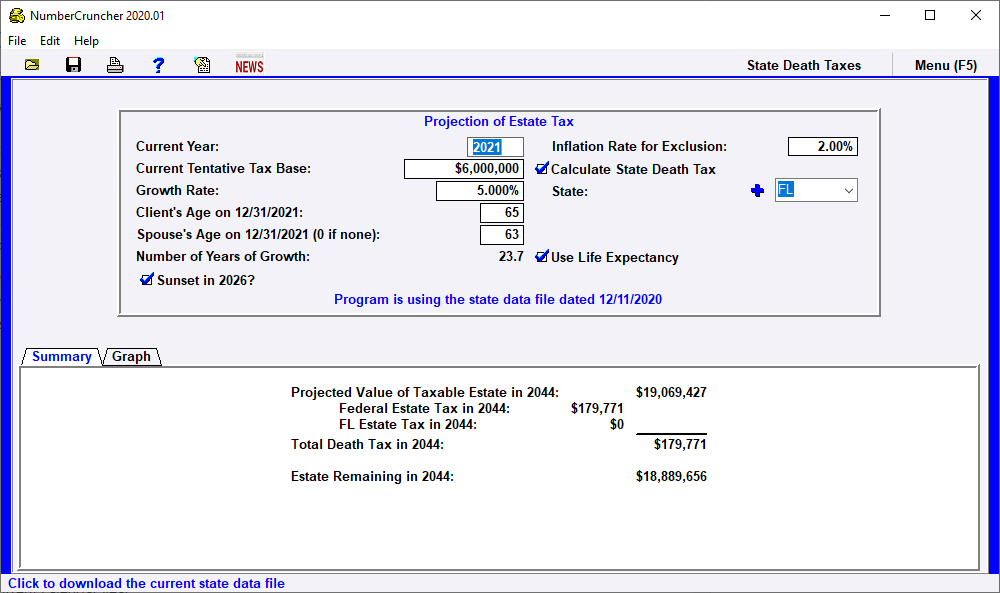

Fast-forward to 2026 and the estate and gift tax exemption.

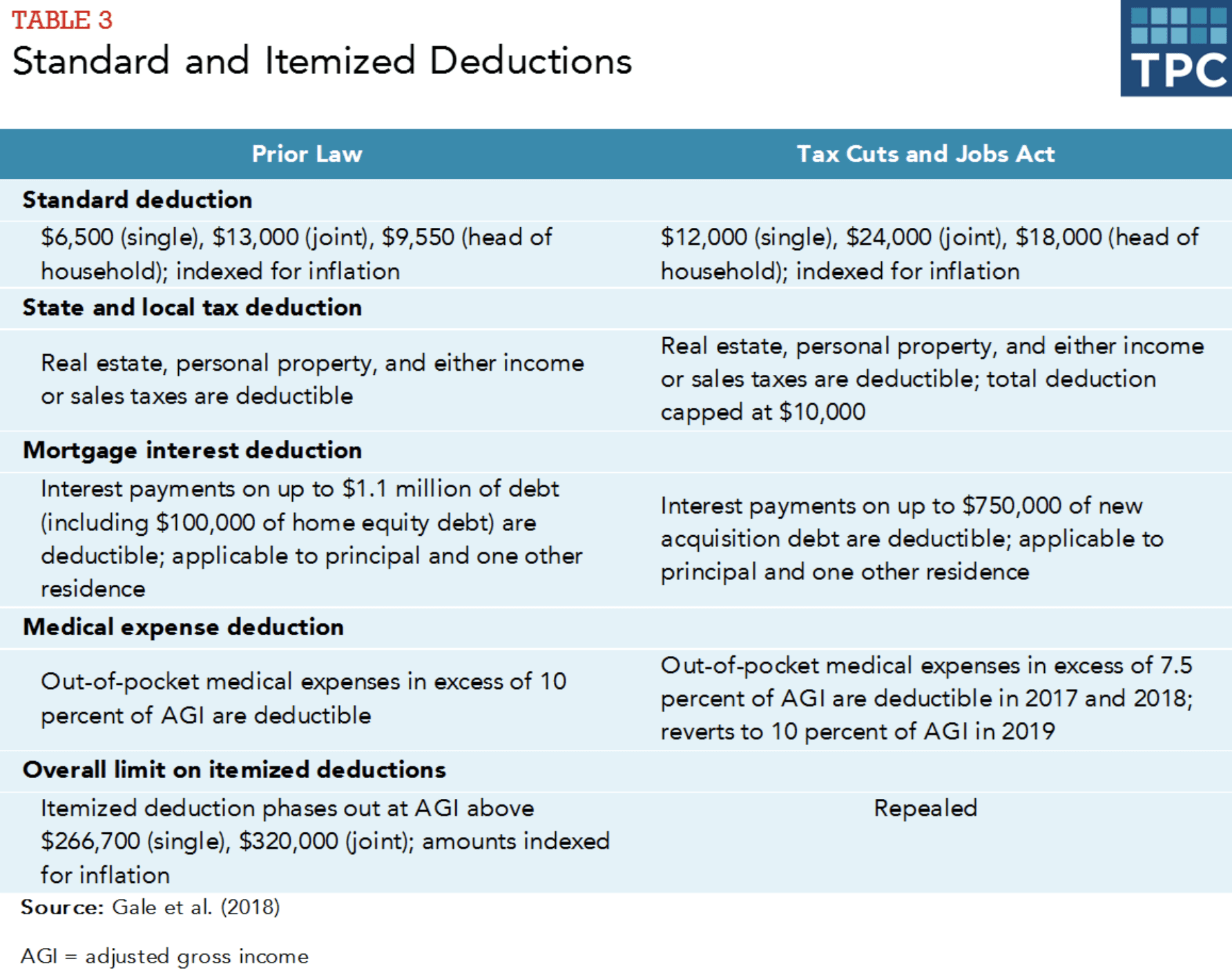

. The 2017 tax law commonly referred to as the Tax Cuts and Jobs Act Pub. Californias Proposition 58 which grants the ability to avoid property value reassessment on inherited real estate went in to effect on November 6 1986. Because the exclusion amount is back to 115 million your estate tax is 46 million.

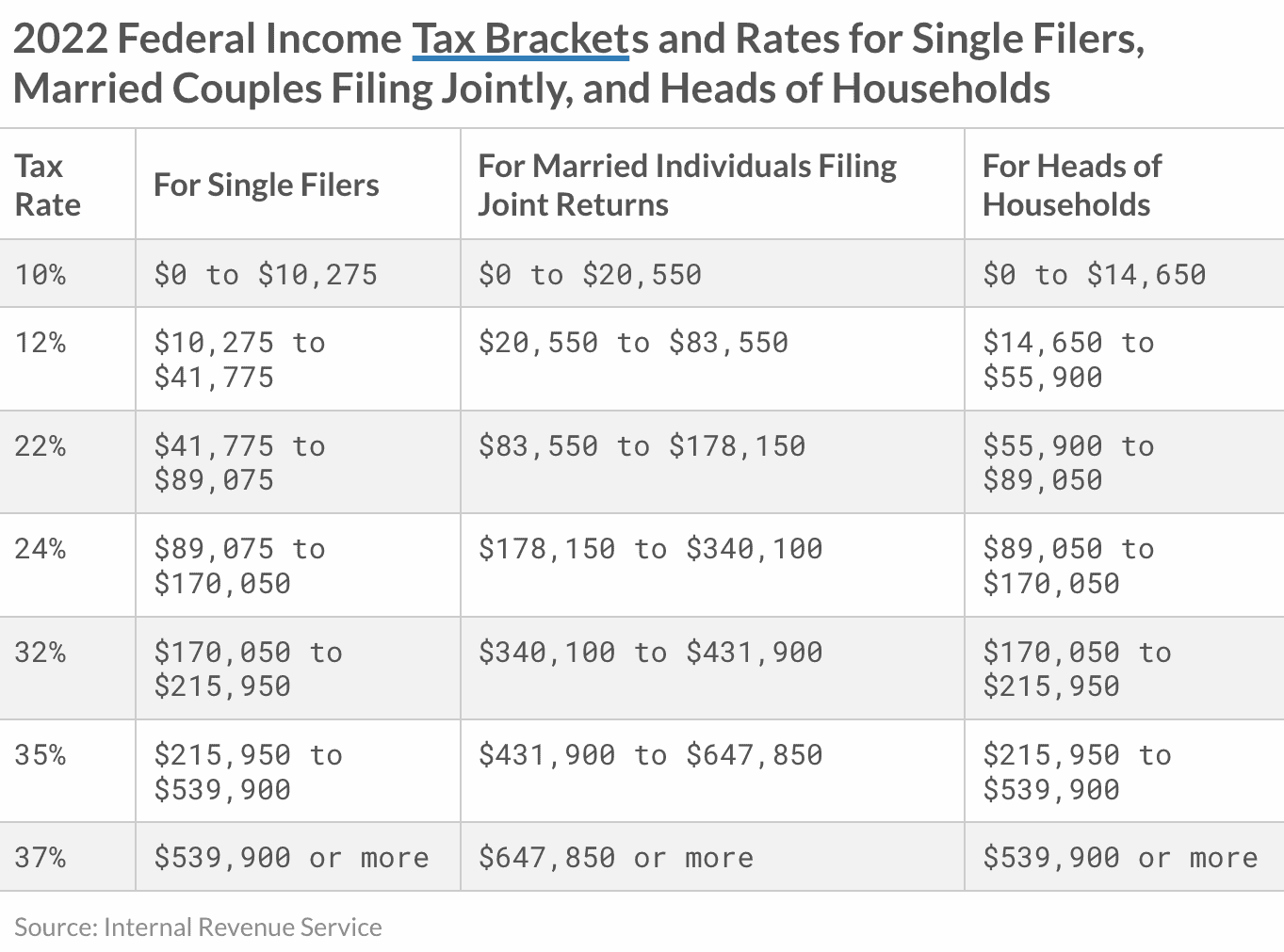

Under current law the estate and gift tax exemption is 117 million per person. Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less. Even though you wont owe estate tax to the state of California there is still the federal estate tax to consider.

After 2025 the exemption amount will sunset a fancy way of. As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with portability. After 2025 the exemption amount will sunset a fancy way of saying end back to the pre-TCJA levels.

As of 2021 the federal estate and lifetime gift tax exemption is 11700000 per individual 23400000 for a married couple with. This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years.

If you have a sizeable estate another large opportunity to take advantage of. Fast-forward to 2026 and the estate and gift tax exemption. The amount of tax shown on the existing annual tax bill must be paid even if the assessed value of the property was reduced by a supplemental assessment.

For gifts over the annual exclusion amount each individual receives a lifetime transfer tax exemption. This basic exclusion amount is 186 percent of the 14 million exclusion amount allocable to those gifts with the result that 1031519 0186 5545800 of the amount. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples.

The federal estate tax goes into effect for. If a decedent dies in 2026 with an estate of 11700000 the exemption amount would be approximately 6000000 creating a TAXABLE estate of 5700000 and an estate. The lifetime estate exclusion amount also sometimes called the estate tax exemption amount the applicable exclusion amount or the unified credit amount has been.

Notably the TCJA provision that doubled the gift. For 2022 the basic exclusion amount for a date of death in 2022 is 6110000. 12 The Bottom Line Every year the IRS evaluates the estate tax exemption.

The first 1206 million of your estate is therefore exempt from taxation. What happens to estate tax exemption in 2026. This transfer tax exemption is unified for both federal gift and estate.

On November 26 2019 the IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when. 115-97 TCJA amended the basic exclusion amount. Federal Estate Tax.

This means the first 1206 million in a persons estate at the time of death is exempt from estate taxes. You can gift up to the exemption amount during life or at death or some combination thereof. 1 You can give up to those amounts over.

However the TCJA will sunset. In 2025 you and your spouse give 115 million to your heirs and file a gift tax return.

Final Tax Bill Includes Huge Estate Tax Win For The Rich The 22 4 Million Exemption

Even Without The Mega Millions Jackpot You Should Probably Have An Estate Tax Return Filed When You Die Marketwatch

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Gifts Of Property And Retained Life Estate Goshen College

18 States With Scary Death Taxes Kiplinger

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

The Life Cycle Of Estate Planning Sandy Cove Advisors

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

California S Property Tax Limits Benefit Real Estate Heirs Don T Mess With Taxes

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

Project Projection Of Estate Tax Leimberg Leclair Lackner Inc

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Tax Rates Sunset In 2026 And Why That Matters Barber Financial Group

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis