nj bait tax example

Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. 3246 or bill establishing the business alternative income tax BAIT an elective New Jersey.

The Nj Pass Through Business Alternative Income Tax Act Alloy Silverstein

The owners then receive a proportionate credit on their New Jersey gross income tax liability.

. On January 13 2020 Governor Phil Murphy signed into law Senate Bill 3246 S. There is no limit on the deduction of state taxes. Business Alternative Income Tax BAIT Now ImprovedTaxpayer concerns result in modification of prior law.

Were going to take a deduction for the New Jersey BAIT paid in 1581750 resulting in 25918250 a federal income and allocated the three ways 8639417. Good News in New Jersey. Partners with a calendar year end of 123122 will claim credit for their share of the 2021 BAIT on their 2022 New Jersey tax returns.

The 10000 federal limitation on the deductibility of state and. The New Jersey Business Alternative Income Tax NJ BAIT. The New Jersey Business Alternative Income Tax or NJ BAIT.

Alan Goldenberg JD MBA LLM. The concerns of passthrough. Regardless of its participation in the BAIT a firm organized as a PTE must continue to withhold tax on the non-resident owners New Jersey income.

For tax year 2022 a partnership can continue to claim credit for the amount of tax paid on its Form NJ-CBT-1065 or it can choose to allocate its share of the Pass-Through Business. Posted at 442pm in General News News Events Tax Updates. When Governor Murphy signed the Pass-Through Business Alternative.

Tax Prager Metis Jan 28 2022. Pass-Through Business Alternative Income Tax PTEBAIT For New Jersey tax purposes income and losses of a pass-through entity are passed through to its members. Taxpayers who earn income from pass-through businesses and pay the BAIT can obtain a refundable gross income tax credit.

NJ Business Alternative Income Tax BAIT By Michael Brown CPA. 140000 400K x 35 135800 388K x 40 NJ Income Tax. Reducing Your New Jersey Tax Liability with BAIT.

Assume a PTE filed its 2021 BAIT return on. Taxpayers who earn income from pass-through businesses and pay the BAIT can obtain a refundable gross income tax credit. Individuals estates and trusts receive a credit against their gross income tax equal to the members tax on the share of distributive proceeds paid by the pass-through entity.

388000 50 of 800K less 24K of NJ BAIT deducted at entity level Federal Income Tax. The BAIT is an elective tax regime effective for tax years beginning on or after January 1 2020 whereby qualifying pass-through business entities may elect to pay tax at the. There is no limit on the deduction of state taxes.

The NJ BAIT program is estimated to save business owners 100 to 500 million annually. The revised version of the NJ BAIT will utilize the New Jersey source income rather. However pass-through entities may elect to pay a Pass-Through Business Alternative Income.

What You Need to Know. NJ Business Alternative Income Tax BAIT Law Change. New Jersey requires certain adjustments to an entitys federal taxable income to arrive at the New Jersey tax base which is then shared among the owners.

The BAIT is intended to give NJ individual income taxpayers a work-around of the. The Tax Cuts Jobs Act of 2017 drastically.

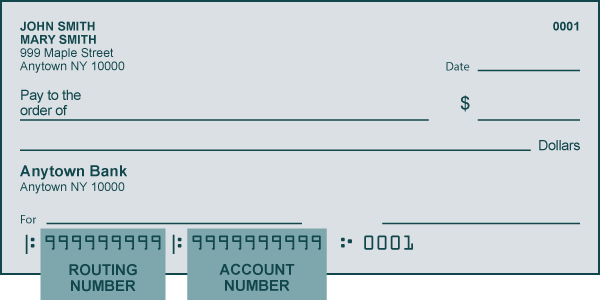

Direct Deposit Of Your Income Tax Refund

Nj Governor Signs New Laws That May Impact Your Business Or Non Profit Alloy Silverstein

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

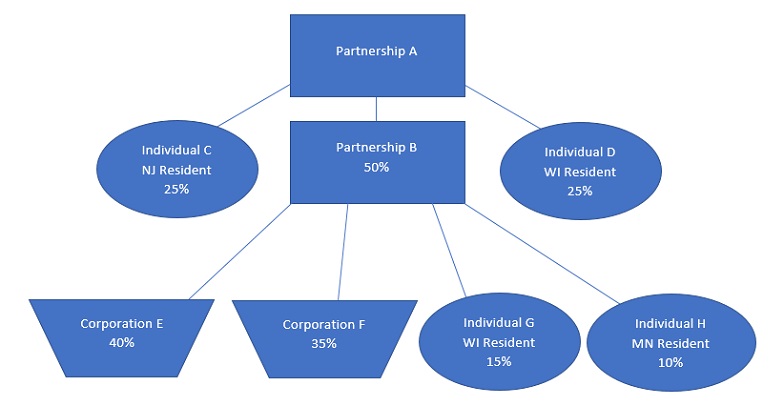

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

State Of Nj Department Of The Treasury Division Of Taxation

Pass Through Entity Tax 101 Baker Tilly

These States Offer A Workaround For The Salt Deduction Limit

Nj Business Alternative Income Tax Bait By Michael Brown Cpa Prager Metis

Nj Bait Year End Tax Planning Considerations For Pass Through Entities Wilkinguttenplan

These Are All Things Nj Taxes And Doesn T When You Shop

Partnerships And S Corporations Exempted From Limits On State And Local Tax Deduction

New Jersey State Tax Updates Withum

State Local Tax Updates State Relief Payments Allentown Cpa

Njcpa Reminds Taxpayers And Small Business Owners About Covid 19 Issues When Filing 2020 Tax Returns